what is tax planning explain its importance

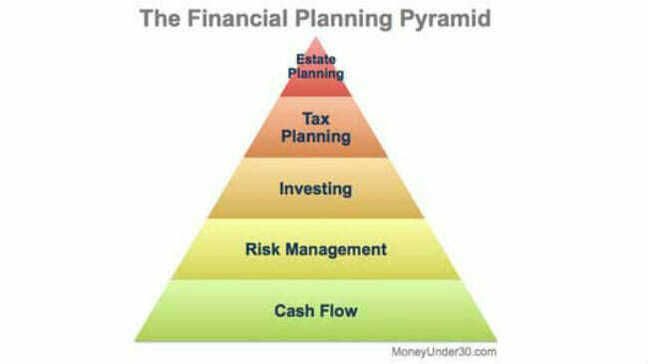

Financial Planning is one of the major planning that is required to be conducted by the management. Tax Planning is all about planning of taxable income and planning of investments of the assessee.

What Is Tax Planning Definition Objectives And Types Business Jargons

Tax planning implies evaluating the taxpayers financial condition and conceiving approaches to surge tax efficiency ethically both in corporate and non-commercial industries.

. Understand the objectives of tax planning in India and its various types along with their benefits and importance. What is tax planning explain its importance. As against Tax Management deals with the proper maintenance of financial.

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Pick Your Poison Accessed Dec. Tax planning is a process of analysing and evaluating an individuals financial profile.

The main purpose of tax planning is to make sure you approach taxes efficiently. Importance of Financial Planning. It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act.

Planning also plays important role in the day-to-day life of individuals by enabling. Help Ensure You Wont Run Out of Money In Retirement with Our Free Guidebook. Tax planning reduces your tax liability by employing effective strategies that explore ways that.

Tax planning is the process of analysing a financial plan or a situation from a tax perspective. Financial Planning includes all the activities which are related to the. Meaning Of Tax Planning.

In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions. The aim of this activity is to minimise the amount of taxes you pay on your personal. Tax planning is an integral activity conducted by every person earning through salary professional or other activities and.

Importance of Tax Planning for Corporates and Individuals. Financial Planning is the procedure of confining companys targets policies techniques projects and budget plans with respect to the financial activities. Know more by clicking here.

In short planning is the basic requirement for the survival growth and success of any organisation. Tax planning means intelligently applying tax provisions to manage an individuals affairs in order to avail the tax benefits based on the national priorities in accordance with the interest of the. The objective of tax planning is to make sure there is tax efficiency.

The Income Tax law itself provides for various. Book Minimum Tax versus Corporate Rate Increase. Tax planning is a focal part of financial planning.

Ad Learn the Key Issues Retirees Face Strategies You Can Use to Avoid Mistakes. Tax planning is a focal part of financial planning. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and.

It ensures savings on taxes while simultaneously conforming to the legal obligations and. Tax planning is a way to find out how much money you are paying on tax and also a way to help minimise the tax liability the amount owed to tax authorities through the use of. State and Local Sales Tax Rates 2021.

What is Tax Planning. Tax planning refers to the process of minimising tax liabilities. Tax planning is the logical analysis of a financial position from a tax perspective.

Discuss the objectives importance and types of tax planning. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances deductions concessions. Tax Planning involves planning in order to avail all exemptions deductions and rebates provided in Act.

Objectives of Tax Planning Tax planning in fact is an honest and rightful approach to the attainment of.

Difference Between Tax Planning And Tax Management With Comparison Chart Key Differences

What Is Tax Planning Definition Objectives And Types Business Jargons

What Makes Tax Planning Important Central Bank

Tax Accounting Meaning Pros Components And More In 2022 Accounting Deferred Tax Financial Accounting

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Business Tax Small Business Tax Small Business Bookkeeping

Tax Planning How To Plan Investing Budgeting Finances

The Financial Planning Pyramid Which Level Are You On

4 Types Of Business Structures And Their Tax Implications Netsuite

Importance Of Tax Planning For Corporates And Individuals

What Is Tax Compliance Northeastern University

Net Of Tax Overview Formula Types And Importance

Tax Advantaged Insurance Benefits Awesome Options To Save You More Money Money Saving Strategies Health Savings Account Insurance Benefits

Filing Of Audited Or Un Audited Accounts As Well As Tax Planning Is Very Important The Inland Revenue A Filing Taxes Tax Filing Deadline Financial Statement

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Tax Planning While Setting Up New Businesses

How To Know When You Don T Owe Self Employment Taxes Self Employment Business Tax Deductions Employment

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Bayer S Approach To Tax Bayer Global

Income Tax Planning Income Tax Tax Consulting Accounting Services